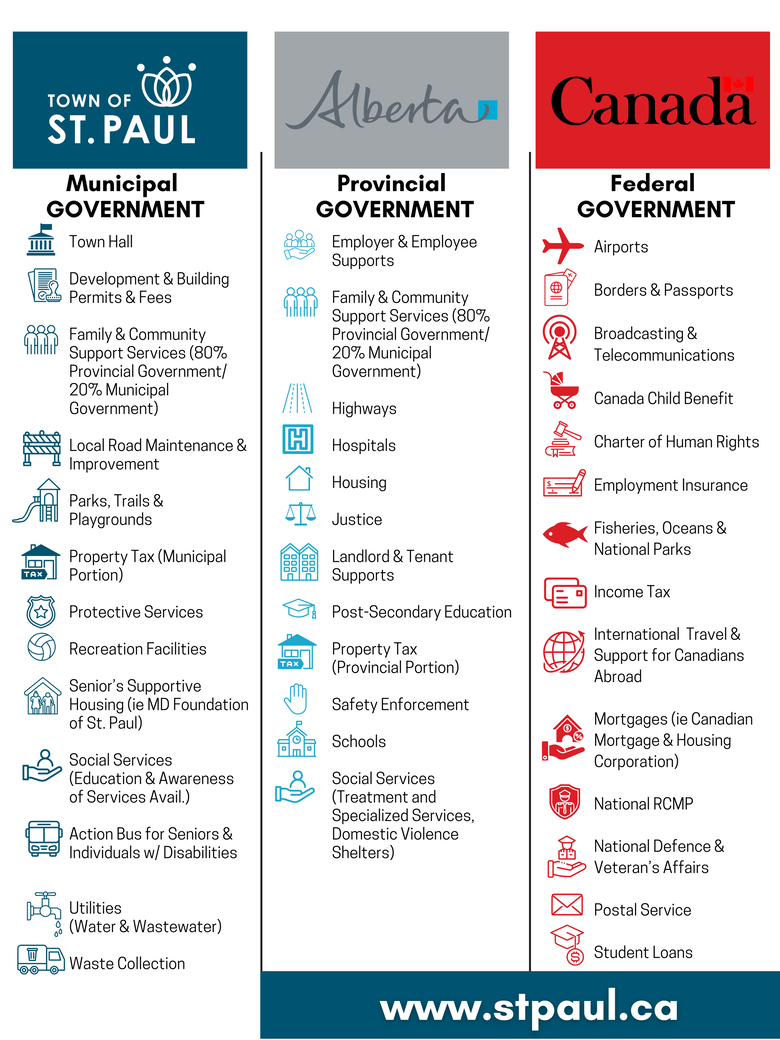

The document outlines the responsibilities of different levels of government—municipal, provincial, and federal—across various services and sectors.…

2024 Property Tax Deadline

A reminder that 2024 Property Tax Payments are due by December 31, 2024. A 15% penalty will be applied to all property taxes with an outstanding balance on January 1st, 2025.

Payment methods continue to be offered in person, online and at financial institutions.

Online: When setting up the Town as a Payee, be sure to select Town of St. Paul Tax Account.

In person: The Administration Office is open Monday - Friday from 8:30am to 4:30pm (incl. between 12pm to 1pm) Please note the office will be closed December 24 at 12pm, December 25, December 26 and January 1st.

Bank: Please check with your financial institutions hours of operation.

If you have any questions regarding your property taxes, please call 780-645-4481 or email.